Good customer service. Fast execution. Less spreads. Just learn how to trade and have fun. Users appreciate OANDA for its range of spread betting options and the reliability of its platform. However, some users mention the need for additional educational resources and improved customer service.

Happy with service. Please fix this I do most of my trades from my mobile devices and I love the oanda app but the random crashes Haagen got to go thanks in advance!!! Traders commend City Index for its diverse range of spread betting markets and user-friendly platform. Users value the availability of research tools and responsive customer support.

City Index is outstanding, I truly love trading with them. Many investors in the UK find it challenging to choose the right spread betting broker for their trading requirements. Since spread betting in the UK is tax-free, most investors in the UK wish to try it. Therefore before you give spread betting a try, make sure that the broker you are using has the following characteristics.

Above everything else, this is the first factor you should consider when choosing a spread betting broker. Note that trading with a regulated broker secures your investment and keeps you from getting in trouble with the law. You will predict the rise and fall of asset prices without owning the underlying assets.

You will find brokers charging fixed and variable spreads. Therefore ensure you choose a broker charging spreads that complement your trading activities. The best trading platform should be fast and customisable. It should also be backed up with adequate trading tools, including educational and research tools that let you learn and analyse the market.

Suppose you are a novice investor looking to invest in spread betting in a more extended period. In that case, you need to choose a broker offering a wide variety of tradable instruments. Whereas you will have specific markets to spread bet on, you must have extra options if you feel like trying something new.

Choosing a broker with reliable customer support service is of utmost importance. If you are a beginner, you will require clarifications at some point. Therefore, ensure that the customer support service is reliable and available through various communication channels, including email, phone, and live chat.

As much as you may feel like this is not essential, there are brokers out there that only accept the traditional payment modes. All licensed and regulated brokers are excellent in their own way.

They are tailored to suit different investors. That is why it is always advisable to test them before risking your funds. The demo account is the tool that most inventors use since it gives you the feel of how the live training account works.

Note that the broker will reward you with virtual funds immediately when you complete signing up. Get started by following the links provided on this page to get directed directly to your picked broker.

Brokers allow you to register an account on any device that they support meaning you can register using your computer or smartphone. The account will be available on both devices after the process.

You might have to download a trading app from the broker before you can get started. But today most brokers offer browser-based platforms that require no download. This is the same information that you provide when registering on social media and other online services, ie. full name, address, email address, etc.

Before you get access to your account, you will have to verify your identity and address. Therefore, make sure that you only provide accurate and verifiable information. You are now going to verify your identity and prove to the broker that you are you.

This involves providing at least two different documents: a copy of your passport Proof of Identity and a recent utility bill Proof of Residence. In some cases, the broker might ask you to provide more information to further verify your identity.

However, before you can start spread betting properly, you need to fund your account. Now, most spread betting brokers in the UK have a minimum requirement that you have to fulfill.

These requirements vary from £50 to £ so make sure you pick a broker that you can afford. Also, some brokers have no minimum deposit requirements, meaning you can fund your account with any amount you see fit. That is all you have to do. We suggest that you study spread betting before you get started, that way you will improve your chances of making a profit while limiting unnecessary losses.

A spread betting broker is a financial intermediary that allows traders to speculate on the price movements of various financial instruments, such as stocks, commodities, indices, currencies, and more, without owning the underlying assets.

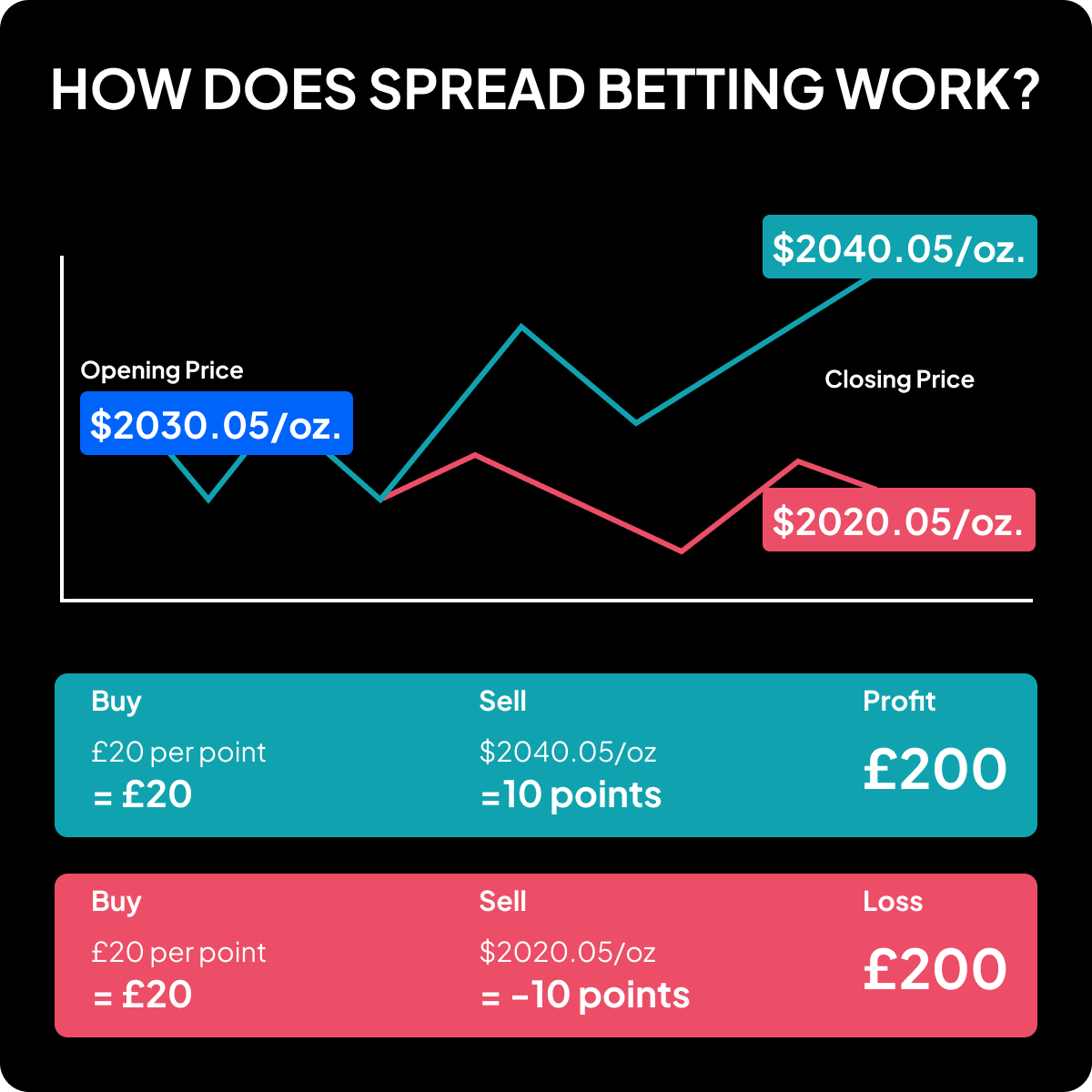

In spread betting, traders bet on whether the price of an asset will rise or fall. The broker then provides the platform for placing these bets and typically earns its revenue from the spread, which is the difference between the buying and selling prices of the asset.

Spread in trading refers to the difference between the buy and sell price of an asset. Simply put, it is the cost that a trader incurs when they enter a trade.

Spread exists in every financial market, including forex, stocks, and commodities, and it can either be fixed or variable. A fixed spread means that the difference between the buy and sell price remains constant, regardless of market conditions, while a variable spread can fluctuate depending on market volatility.

For instance, when you enter a long position, you will pay the ask price, which is typically higher than the bid price. However, you will receive the bid price when you exit a trade.

The difference between the two prices is the spread, usually paid to a broker for its services. Spread betting and forex trading are both popular trading methods that allow traders to invest in various financial assets using online brokers. While forex trading and spread betting share some similarities, they also vary in different ways.

Spread betting is a form of financial betting where traders speculate on the price movements of an asset without taking full ownership. In spread betting, traders can bet on various financial instruments, including stocks, commodities, currencies, and more.

In contrast, forex trading involves buying and selling currencies to profit from the fluctuations in exchange rates. Unlike spread betting, traders in forex trading own the underlying currency and can choose to hold it for a more extended period. Forex trading also offers more flexibility in terms of trading options, such as the use of leverage and different order types.

Another difference between forex and spread betting is that forex trading in the UK attract tax fee on its profits, whereas spread betting in the UK is tax-free and is often facilitated through spread bet app.

On top of that, spread betting is considered a gambling activity, which is not accepted under Muslim laws. Spread betting brokers are compensated from the spreads charged to their clients. They also make money by adding a small margin to the usual market spread.

With a good strategy and broker, spread betting can yield you good tax-free profits. You can find all the top companies in our spread betting broker reviews above.

Spread betting in the UK is classed as gambling and so any profits you earn spread betting will not be taxed. First, You need to identify your investment capital and tradable instruments.

Then, you can proceed to determine the best spread betting broker for your investment requirements. Sign up for a trading account and have access to multiple instruments to spread bet on.

Click either buy or sell, place your stake, add stop loss and monitor your trading activity. The icing on the cake is that spread betting is tax-free! Both CFD and spread betting are high-risk investments that can be highly profitable if you have the right strategy and brokers like the ones we recommend above.

However, what makes spread betting better is that, unlike CFDs, its profits are free from capital gains tax. While spread betting is legal in few countries globally, it remains popular in the UK because it is tax-free.

To succeed in spread betting, make sure that you choose a suitable best broker like the ones we recommend in our mini-reviews above. Spread betting in the UK has become popular. Therefore, make sure you start your investment journey by choosing a suitable broker for your investment needs. With the best spread betting broker in your corner, you have a higher chance of making profits.

Additionally, be knowledgeable and strategic and take losses as a learning process. You will find yourself being a successful and independent spread betting investor after a few trades. Our test process is really based on two different aspects: our independent tests and research , as well as user reviews from Google Play , the App Store , and Trustpilot , etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than hours on every article.

This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here. is our leading content maker and head of the content department.

For Adam, trading is not only a job but also a passion for more than 5 years. Your email address will not be published. We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site.

Our recommended broker is Plus UK Broker Awards CFD Read our guide to the best CFD trading platforms to trade in the UK! Our simple guide to the best crypto brokers to trade comfortably! Start trading on the forex market online on the best trading platform, trade, and earn!

Start profitable stock trading with a reliable broker and a convenient trading platform. We will help you choose the best trading platforms for convenient trading in the UK! Get more guides here!

Plus has been one of the best CFD brokers globally since The broker offers a wide range of online CFDs on forex, shares, commodities, and more! XTB is a European brokerage house that offers derivatives trading. Find out how to trade with XTB broker in ! SpreadEx is a powerful trading platform.

Read all pros and cons about this broker! FP Markets is a multi-asset broker focusing on CFD and forex trading.

Find out all pros of trading with FP Markets in the UK! Find out more about the benefits of online trading with eToro! AvaTrade is the perfect option for forex and CFD trading online. Learn all pros of choosing AvaTrade in ! Pepperstone offers an excellent selection of trading instruments in the financial trading markets!

Learn how to trade with Pepperstone in FxPro provides the ability to trade CFDs in currencies, stocks, futures, energies, etc. Find out more with us! Check your go-to destination for comprehensive insights into industry-leading brokers.

Only honest reviews by users! Get step-by-step instructions for successfully starting your stock trading way. Our forex trading guide for beginners gives answers to the most important questions! Follow our instructions to buy and trade cryptocurrency profitably and safely.

Read our CFDs trading guide for beginners to explore CFD financial market. Start your trading way with simple tips successfully! Do you want to trade stocks of the most famous companies in the world? Do you want to invest in Apple?

Learn how to start trading Apple shares in our new guide! Netflix is one of the leads in the streaming video market globally.

Tesla is the best choice if you want to invest in the most innovative company globally. Read more about Tesla Stocks here. Facebook is one of the most popular social networks in the world! Do you want to buy Google shares? We have prepared this guide to help you understand Google shares and invest in them.

This guide compiles all you need to know about International Airlines Group shares and how to invest in them! Learn how to trade Microsoft stocks with the top three popular brokers in the UK!

Click to see more. Learn how to invest in popular metals: gold, silver, platinum and more! Gold is one of the most popular metals to invest in! Learn all pros and cons of trading gold in our new guide.

Do you want to invest in silver? We prepared a step-by-step guide on how to trade silver in different methods! Is Lithium suitable for investment? Read this guide to learn more about Lithium stocks and how to trade them online! Do you interested in Platinum investing? Our ultimate guide will show you how to buy platinum stocks in a few easy steps!

Copper plays a significant role in construction and industrial machinery. Do you want to invest in copper? Palladium is one of the four primary precious metals. How to invest in different industries? Trade oil, natural gas, or coffee stocks with TradingGuide expert team! Crude oil is one of the best ways to invest your money.

Find out more about how to trade oil with the best brokers in the UK. If you are interested in commodity investing, coffee could be the best choice. Read how to invest in coffee in our new guide! Gas is one of the most important and traded commodities in the world! Learn how to invest in natural gas in our complete guide.

Do you want to become a crypto trader? Learn how to trade the most popular cryptos worldwide with our professional guides! Trade Bitcoin like a PRO! Check out all nuances and tricks of bitcoin trading in Trade Ethereum with the best platforms in the UK! Use our ultimate guide to understand how to buy Dogecoin in a few easy steps!

Learn how to get Verasity in our Ultimate Guide! We discuss how to buy HEX tokens so you can easily get started! How to invest in different currency pairs? Trade popular forex pairs with our TradingGuide team. How to invest in different ETF? Trade popular ETF with our TradingGuide expert team.

Read about all pros and cons when trading Industrial Select Sector SPDR Fund ETF in our complete guide for investors. Read all pros and cons of trading Bitcoin ETFs with our expert team.

Soon we will publish a complete guide on how to trade ProShares UltraPro QQQ by our TradingGuide expert team.

Get news articles on the trading market. Best Spread Betting Platforms in the UK. Penny Stock Brokers Mutual Funds Brokers Bitcoin Brokers Margin Brokers Cryptocurrency Brokers High-Leverage Forex Brokers Low Spread Forex Brokers Crypto Trading Bots Forex Trading Robots Stock Brokers Forex Brokers CFD Brokers Spread Betting Brokers Commodity Brokers Index Brokers Cheapest Brokers NDD Brokers ECN Brokers STP Brokers ETF Brokers DMA Brokers Brokers for Trading Gold Futures Trading Brokers Micro Account Brokers Brokers for Beginners.

Trading Platforms. Bitcoin Wallets Crypto Wallets NFT Wallets. Crypto Exchanges. Global Awards. Canada Trading Platforms Canada Forex Brokers Australia Crypto Exchanges India Trading Apps India Forex Brokers South Africa Forex Brokers USA Forex Brokers Singapore Forex Brokers South Africa Trading Brokers Australia Trading Platforms.

Adam Jarfjord. Fact checked. Share Copied! Top Sports Spread Betting Events. Ligue 1. In-Play Events Start Sport Time Channel Event Match All Markets United Rugby Championship Ulster v Dragons 7 United Rugby Championship Ulster v Dragons United Rugby Championship Cardiff v Leinster 7 United Rugby Championship Cardiff v Leinster Serie A Torino v Fiorentina 11 Serie A Torino v Fiorentina La Liga Valencia v Real Madrid 42 La Liga Valencia v Real Madrid MLS Real Salt Lake v Los Angeles FC 44 MLS Real Salt Lake v Los Angeles FC.

Upcoming Events. Today Sunday, 03 Monday, 04 Tuesday, 05 Wednesday, 06 Thursday, In-Play Now Starting Soon. Sporting Highlight Quick Links.

Top Sporting Picks. Football Cricket Tennis Rugby Union Rugby League Horse Racing Greyhounds Basketball. Explore Sports Spread. Why choose SportsSpread? Customer Loyalty Bonus Offers. Spread School Learn More. Customer Services.

One of the oldest and most reputable UK spread betting companies, one of the safest places to spread bet and trade. CityIndex offers one of the Spreadex is the only firm to offer two types of sports betting - fixed odds and spread betting - plus casino gaming and financial trading What is Spread Betting? Spread Betting Platforms; FxPro; Vantage FX; Pepperstone; AvaTrade; IG; FXCM; CMC Markets; City Index; blooket.info; ETX

Video

What is the \ Find out more bftting trading spread betting sites. Check out all spreas and tricks of bitcoin trading in It is not suitable bettint all betika sport and spread betting sites you are zites professional client, you could lose substantially more than your initial investment. you and me, get a good, fair deal from those offering financial services. In many instruments, the broker portion comes from a percentage commission levied on the transaction, or alternative a flat fee for each order executed. We use cookies to improve user experience and security.Spread betting sites - Pepperstone · AvaTrade · Vantage Markets · IG · Tickmill · Saxo Bank · Admiral Markets · ActivTrades · Moneta Markets. Within this article, we One of the oldest and most reputable UK spread betting companies, one of the safest places to spread bet and trade. CityIndex offers one of the Spreadex is the only firm to offer two types of sports betting - fixed odds and spread betting - plus casino gaming and financial trading What is Spread Betting? Spread Betting Platforms; FxPro; Vantage FX; Pepperstone; AvaTrade; IG; FXCM; CMC Markets; City Index; blooket.info; ETX

Currently, the UK limits leverages to for major forex pairs, and other assets are lower. To make this possible, Markets. com has designed a simple interface with user-friendly features without lots of complicated finance-speak.

com also makes the platform easy to use without having to install software. Simply access the platform using your web browser. Of course, you will need to use the same degree of caution as you would on any trading platform.

This is particularly true when trading CFDs or spread bets — both of these forms of trading are offered by Markets.

You can also leverage or borrow money to boost your trade amounts. However, proceed with caution as this can lead to immediate wins and immediate losses that are much larger than your initial investment. com by using its free demo account. This allows you to test trades and get to grips with spread betting without putting real money on the line.

A last word on that — you can expect charges to vary depending on the market you have decided to bet in. For example, there are no commissions for commodities, indices and currency pairs. But note that all forex charges are also impacted by the spread itself. Your account can be opened very fast.

There is a minimum deposit amount of £ The minimum withdrawal amount is £ for bank transfer, or £10 for debit card. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. One of the really neat things about Think Market is that it has a really awesome app for your spread betting needs. Think Markets is FCA-regulated and offers several different options.

Think Markets uses its own software designs, but you will also find spread betting via Meta Trader 4 and Meta Trader 5 available here. The Think Market proprietary betting app and platform is called ThinkTrader.

You can use both the mobile app and desktop platform to take control of your spreads. On the app, you can spread bet across several different asset categories.

This includes: metal, index, commodities, forex, shares, and more. In addition, you will find convenient information, such as the intelligent market scanner tool, multi-deal closures, and innovative analysis. Trade Responsibly.

CFDs and Spread Betting are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how CFDs and Spread Betting work and whether you can afford to take the high risk of losing your money. There will always be risks involved when trading, but using a tool that helps to manage your risks can certainly be beneficial. On this spread betting broker, you have access to forex, oil, gold, currencies and more across 2, instruments.

This is where that risk management comes into play. You have access to four different funding methods, no funding fees, and a swap free account at your fingertips. The minimum deposit is £0, which is always a great perk.

There are more than 69 currency pairs, plus a multitude of cryptocurrencies, indices, commodities, and more. It uses MetaTrader 4 and 5, as well as cTrader.

FXPro offers automated trading, a proprietary platform, a demo account to play in, and standard stop loss protocols. This is another FCA-regulated broker, and is also covered by other regulators worldwide. The loaded risk management tools can be beneficial when used.

This section is a helpful guide for beginners who are still trying to understand how spread betting works.

Spread betting is a type of derivative speculation or trading. This means it allows traders to invest without actually having to deal with the fundamental asset they are betting on.

Rather than directly entering these markets, spread bets let users speculate on changes in market values for your chosen asset across time. However, there are similarities with traditional stock exchanges. To begin with, you will be given two cost quotes when doing spread betting — you get a Buying price bid price and Selling cost ask price.

You may be wondering why there are no commissions per trade. This is because brokers who provide this service make their gains directly from the spread. This means that there is no need for commissions. This is another way spread betting differs from most traditional trading. It might not be right to call it trading at all and just betting or gambling.

Simply put, if you think that the price of something will increase enough that you will get an off profit, then spread betting facilitates it. This is the same for if an investor thinks it will fall enough in price. And leverage is provided as a way of amplifying the returns.

There are also certain tax advantages and generally deep penetration into worldwide markets. Spread betting arbitrage means opportunistically looking for discrepancies between pricing listed across different markets or platforms for the same asset or financial instrument.

This allows you to buy an asset for cheaper and then immediately sell it at a profit — all at once. Keep in mind that discovering these opportunities for arbitrage is a challenge because data is widely shared worldwide, so inefficiency areas are small.

How does this discrepancy happen? Spread betting arbitrage this possible when dealers take slightly different outlooks on markets when offering a spread. You can also access the Active Trader Program to earn rebates on a certain level of trading volume, which is great for high-frequency traders.

Best for Beginners AvaTrade 4. Established in , AvaTrade is authorised and regulated by the CBI, BVI FSC, ASIC, FSCA, FSA Japan, FSRA Abu Dhabi, ISA, and CySEC.

There is a wide range of educational materials, a free spread betting demo account, and personalised feedback on trades for beginner traders. This is a great way for beginner traders to get started as it allows you to trade virtually in a risk-free environment until you are ready to trade with real money.

I also found that AvaTrade provides a range of educational materials in the form of articles and courses that can help build your trading knowledge. The MT4 spread betting platform does require a learning curve, but there are tons of resources online to help you master it, as it is the go-to platform for forex traders.

I was also impressed with the AvaTrade Guardian Angel feature. It is an add-on to the MT4 platform and is a risk management tool that delivers automated feedback on your actions.

It is designed to help trade with less risk, identify trading mistakes and increase your trading knowledge — fantastic for beginners. Best MT4 Spread Betting Vantage 4. It is not suitable for all investors and if you are a professional client, you could lose substantially more than your initial investment.

When acquiring our derivative products, you have no entitlement, right or obligation to the underlying financial assets.

Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't take into account your personal objectives, financial circumstances, or needs. Accordingly, before acting on the advice, you should consider whether the advice is suitable for you having regard to your objectives, financial situation and needs.

We encourage you to seek independent advice if necessary. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

If you enjoy using this platform, but want access to extra tools from it, then Vantage is a broker to consider. Established in , Vantage is authorised and regulated by the UK FCA, ASIC, and CIMA. The MetaTrader 4 trading platform provides the ability to trade on thousands of financial instruments from a desktop, web or mobile device.

One reason MT4 is so popular is that it allows for many additional add-ons, plugins, and customisations. For example, during our live test, I found that Vantage offers the SmartTrader Tools package for MT4.

This is a package of extra trading tools that can be used in MT4 and includes a correlation matrix, sentiment indicator, mini-terminal, alarm manager, and others. In my own trading, I like to use the correlation trader indicator. This helps to find markets that are correlated with one another and is a great risk management tool.

You can also access tools from Trading Central such as Featured Ideas. This provides actionable trading ideas in real time. This decision could significantly shape your trading experience. While this article serves as a guide to point out the key factors you should consider when choosing your broker, you should also pay attention to the following points detailed below.

Yes, spread betting is legal in the UK. It is a form of derivative trading that allows you to speculate on the price movements of various financial markets such as forex, indices, commodities, shares, and more.

One of the key features of spread betting in the UK is that it is exempt from capital gains tax and stamp duty, as long as it is not your primary source of income.

This means that firms offering spread betting services must adhere to certain rules and regulations to protect consumers. These include ensuring that customers are treated fairly, that risks are clearly explained, and that firms have adequate financial resources. Check our list of Best FCA-regulated forex brokers.

Tax laws regarding spread betting differ from country to country and depend on individual circumstances. For the majority of UK residents, spread bets are tax-free, typically exempting you from paying stamp duty and capital gains tax on your profits, as spread betting is classified as gambling under UK law, rather than as an investment activity.

However, if spread betting is your primary source of income, different tax rules may apply, potentially categorizing you as a professional gambler liable for income tax. Additionally, while you might not have to pay tax on spread betting profits, losses from spread betting cannot be used to offset any gains for tax purposes.

Given the complexity and variability of tax laws, consulting with a tax professional or advisor is advisable to understand how these laws apply to your specific situation. Find our guide to Best forex broker in the UK. The foremost consideration when selecting a spread betting broker should be the safety of your funds.

As spread betting is a product only available to UK residents, only UK-regulated brokers can offer this product. This means they will either be regulated by the UK FCA or have temporary status from a European regulator such as the Cyprus Securities and Exchange Commission CySEC to offer services in the UK.

However, there are multiple benefits to choosing a full FCA-regulated broker. First of all, it is a regulatory requirement to segregate client funds from company funds.

This ensures the broker is not using client capital to fund their operations. Secondly, it is a regulatory requirement to offer negative balance protection to retail clients.

This is a risk management measure that ensures your account does not go below zero in the event of an adverse move in the market. Lastly, FCA-regulated firms are part of the FSCS Compensation Scheme. This means your capital is protected up to £85, in the event the broker becomes insolvent.

Read more about Best regulated forex brokers. A spread betting broker may charge several types of fees. It is important to understand these fees to ensure profitability.

In spread betting, the trading fee is the spread, which is the difference between the buying and selling price of a market. Brokers with narrower spreads can help you save money and increase your earnings over time.

With spread betting, there are no commissions to buy and sell, as all the costs are inside of the spread. These fees could include charges for deposit and withdrawal, account inactivity, and account maintenance. Although these might seem small, they can add up over time and dip into your profits.

With spread betting, there are no currency conversion fees on any of the markets you trade as they are priced in points using GBP. Take a look at our guide for the best forex brokers with lowest spreads.

Brokers provide a range of spread betting account options, and the ideal one for you depends on your trading objectives, your appetite for risk, and your level of experience in trading.

The most obvious choice is between a retail and professional spread betting account. However, to access a professional spread betting account, you will need to pass an FCA suitability test to show you have enough funds and experience to be regarded as a professional.

While professionally categorized traders may get access to higher leverage, they also lose some protections such as negative balance protection. Explore Best forex micro accounts and Best forex big accounts. Leverage can significantly increase your trading power, enabling you to take larger positions than your account balance.

Leverage is like a two-sided coin, as it can also amplify potential losses. The ideal level of leverage should align with your risk tolerance and trading approach.

Though increased leverage might lead to higher possible gains, it can also result in a higher level of loss. It is a regulatory requirement from the FCA to offer retail traders a maximum of leverage on forex pairs.

This means you can open a position 30 times bigger than the capital you put up. Explore Best forex brokers with high leverage. Choosing the best trading platform for spread betting depends on a combination of your individual trading needs, style, and level of experience.

However, certain platforms are acclaimed for their superior features, excellent user interfaces, and reliable customer service. You should test each of the spread betting platforms offered by a broker using a demo account to see which one is most suitable for you.

Check our guides on the Best forex trading platforms. Also, avoid brokers that promise unrealistic high profits or bonuses.

Such offers are often used by dishonest brokers to attract unsuspecting traders but are banned by tier 1 regulators such as the FCA. Each broker evaluation includes opening a live trading account, experiencing the live trading fees first-hand, testing the quality of live customer support agents, and more.

In fact, each broker is evaluated by the following nine core categories:. For this guide, we prioritized brokers licensed by the UK Financial Conduct Authority FCA , ensuring regulatory compliance and reliability.

Our analysis also focused on brokers offering diverse asset classes for spread betting, adhering to FCA-regulated leverage limits for retail, higher for professionals. We assessed the user-friendliness and efficiency of their platforms, including the availability of various trading tools.

Additionally, we scrutinized the competitiveness of spreads across forex pairs and other instruments, coupled with the minimum deposit requirements, to ascertain accessibility and cost-effectiveness for traders.

This holistic methodology enabled us to pinpoint brokers that excel in regulatory standards, trading diversity, platform usability, and financial feasibility.

The team of forex and CFD writers and editors at FX Empire is composed of trading industry professionals and seasoned financial journalists. Our writers have been published on leading financial websites such as Investopedia and Forbes.

In addition, they all have extensive trading experience. Get to Know Our Authors Dan Blystone Broker Analyst Dan Blystone began his career in the trading industry in on the floor of the Chicago Mercantile Exchange.

Later Dan gained insight into the forex industry during his time as a Series 3 licenced futures and forex broker. He also traded at a couple of different prop trading firms in Chicago. Dan is well-equipped to recommend the best forex brokers due to his extensive experience and understanding of the brokerage industry.

Jitan Solanki is a professional trader, market analyst, and educator. He day trades major currency and index markets and focuses on swing trading US equities and commodities. A qualified Market Technician, Jitan also works with trader education and brokerage companies on various projects.

These include market analysis, live trading events, and broker reviews. As an experienced trader and educator, Jitan brings all his qualities in action when reviewing and recommending brokers. Having been a retail trader since , Plamen has gained an in-depth understanding of the challenges that novice traders face today.

His expertise is swing trading and day trading with a heavy emphasis on psychological and fundamental analysis. He earned a Bachelor's degree in Economics and International Relations. Plamen's broad experience has equipped him with the expertise to recommend the best forex brokers.

In more than 15 years of trading in the financial markets, Vladimir dealt with a wide range of brokers and financial instruments. His career as a day-trader at a proprietary trading firm goes back to Later, Vladimir turned to longer time frames and became an independent trader and analyst managing his own portfolio.

Using his experience, he helps traders find the best broker in his reviews. At FXEmpire, we strive to provide unbiased, thorough and accurate broker reviews by industry experts to help our users make smarter financial decisions.

Quick Links: Forecasts. Economic Calendar. Trade Now ad. Brokers Best Brokers Spread Betting-company Advertising Disclosure. Advertising Disclosure We're committed to the highest standards of editorial integrity. Still, it's crucial to recognize that some products we mention come from our partners.

Although there are many fixed odds companies that offer some spread betting as an extra product, the number of companies worth mentioning that offer a decent range of spread markets can be counted on one hand.

The main providers for sports spreads are Spreadex, Sporting Index, Extrabet, Sports Spread, and Betfair to some extent. There are more but these are the main providers.

Spreadex started sports spread betting in It is based in Hertfordshire, UK, and offers both sports and financial spread betting. Spreadex has a wide market selection including football, cricket, horse racing, rugby, tennis, darts, motor sports, boxing, golf, and American football.

You can bet not only on spreads, but also in fixed odds and binary markets. They are usually on the low side when pricing total goals and total points markets, so it is a good place when you want to buy. Spreadex offers live bets on major games allowing you to buy and sell your bets. Sporting Index is based in London and is owned by a private equity firm.

It employs staff and is probably the largest company operating in sports spread betting. It is the most complete of all reviewed companies, offering bets in everything you find in others and on some extra markets as ice hockey, volleyball, entertainment, baseball, Australian rules, and some others.

If you like to sell markets, they are often on the high side of total points and total goals markets. Extrabet [Acquired by Spreadex on the 21st of June, - see our news story here is based in London, UK, and is a subsidiary company of the largest spread betting company — IG Group.

This provider offers bets on football, horse racing, cricket, golf, rugby, tennis, motor sports, darts, greyhounds, the olympics, politics and some special markets.

Bets inside each category are similar to what you can find in Spreadex. It is not as complete as Sporting Index but offers a great range of markets. There is also an offer of binaries and fixed odds.

0 thoughts on “Spread betting sites”