Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Develop and improve services. Use limited data to select content. List of Partners vendors. Among the many opportunities to trade, hedge, or speculate in the financial markets, spread betting appeals to those who have substantial expertise in identifying price moves and who are adept in profiting from speculation.

But this particular strategy isn't for everyone because it can be risky and result in major losses. It is also illegal in many jurisdictions. But if spread betting is legal in your market, here are a few strategies you could follow. Spread betting involves placing a bet on the movement in an asset price.

The person making the bet doesn't actually need to own the underlying security. Rather, they bet on the movement in its price. Because it relies on speculation, spread betting is often considered to be a form of gambling.

One thing should be made clear about spread betting: The practice is illegal in the United States. That said, it's still a legal and popular practice in some European countries, particularly in the United Kingdom. For this reason, all examples quoted in the following strategies are cited in British pounds GBP.

Popular betting firms like U. Users can engage in spread betting on assets like stocks, indices, forex, commodities, metals, bonds, options, interest rates, and market sectors. Technical analysis is an investment strategy that involves the use of historical data and information to make predictions about the future movement of asset or market prices.

Technical analysts may use stock charts , graphs, and past prices as some of the tools in their trading activity. This can also be applied while spread betting. To do so, bettors often apply trend following , trend reversal , breakout trading, and momentum trading strategies for various instruments, and across various asset classes such as commodities, FX, and stock index markets.

Spread betting comes with high risks but also offers high profit potential. Other features include zero taxes, high leverage , and wide-ranging bid-ask spreads.

Corporate moves can trigger a round of spread betting. For example, let's consider when a stock declares a dividend and it subsequently goes ex, which means it is set to expire on the declared ex-date. Successful bettors keep a close watch on particular companies' annual general meetings AGMs to try and get the jump on any potential dividend announcements or other critical corporate news.

Say a company whose stock is currently trading at £60 declares a dividend of £1. The share price starts to rise up to the level of the dividend. In this case, that's somewhere around £ Before the announcement, spread bettors take positions intended to gain from such sudden jumps. For example, let's assume that a trader enters a long-bet position of 1, shares at £60, with a £5 per point move.

So in our example, with the £1 price increase upon the dividend announcement, the trader gains:. Similarly, bettors will seek to take advantage of the dividend's ex-date. Assume that one day before the ex-date, the stock price stands at £ Previous Next.

Sports Spread Betting Since Top Sports Spread Betting Events. United Rugby Championship. In-Play Events Start Sport Time Channel Event Match All Markets MLS Real Salt Lake v Los Angeles FC 44 MLS Real Salt Lake v Los Angeles FC United Rugby Championship Ulster v Dragons 7 United Rugby Championship Ulster v Dragons United Rugby Championship Cardiff v Leinster 7 United Rugby Championship Cardiff v Leinster Serie A Torino v Fiorentina 11 Serie A Torino v Fiorentina.

Upcoming Events. Today Sunday, 03 Monday, 04 Tuesday, 05 Wednesday, 06 Thursday, In-Play Now Starting Soon. Sporting Highlight Quick Links.

The competitive fees and fast execution will serve serious short-term traders, whilst the BnkPro investment service will appeal to those looking for long-term e-money solutions. FxPro has also picked up more than industry accolades for its competitive trading conditions, including fast execution and deep liquidity.

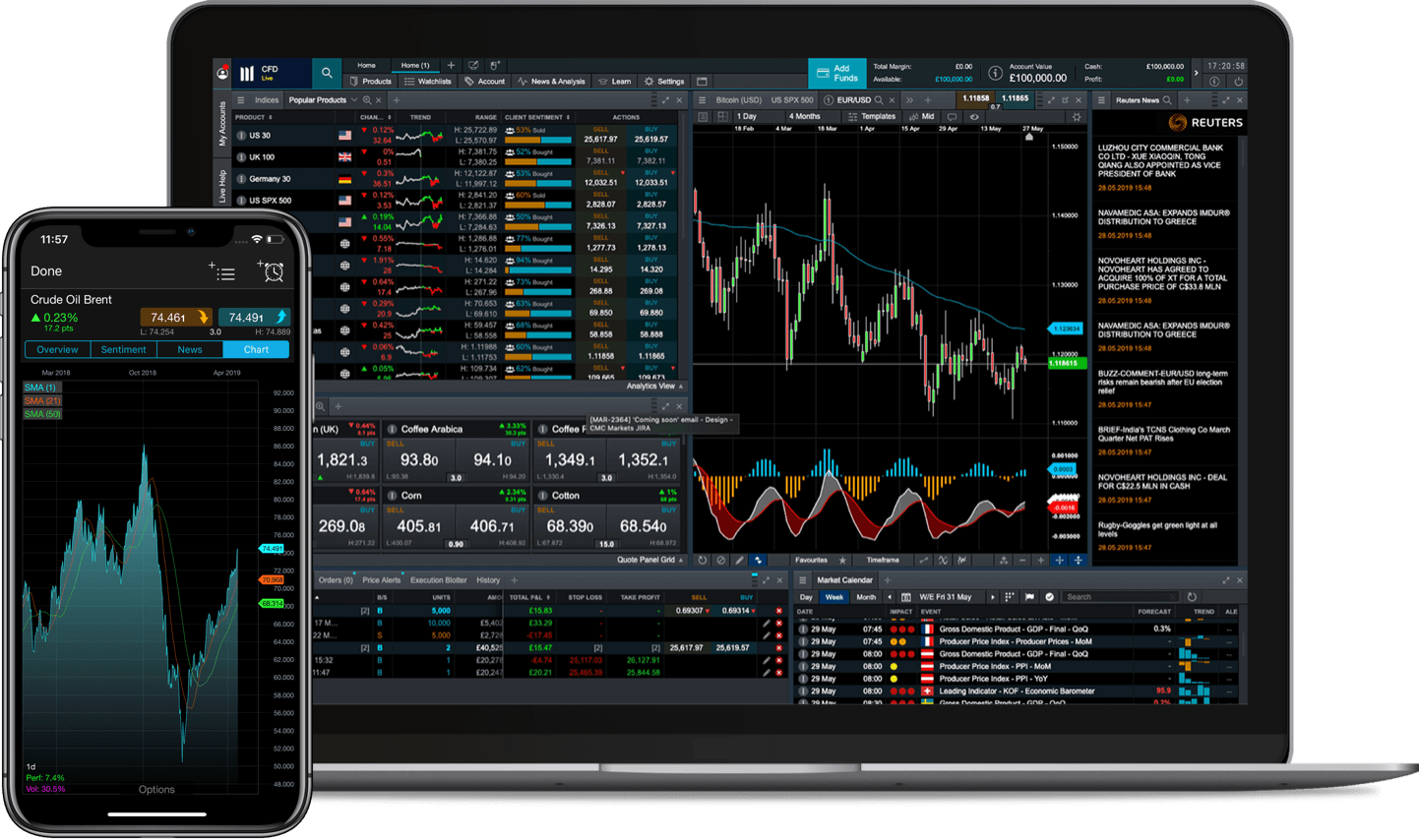

CMC Markets is still one of the few brokers that lets you make speculative bets on financial markets without incurring capital gains tax on your profits.

Its web platform has also won awards for its top-notch user experience. Established in , CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO.

More than 1 million traders from around the world have signed up with the multi-award winning brokerage. Vantage continues to offer commission-free trading on global markets with tax-free profits for traders from the UK and Ireland. Helpfully, you get access to all the same platforms for spread bets, as well as commission-free trading.

You can trade Forex CFDs from 0. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Spread betting is a trading method where you speculate on the price movement of financial assets, such as stocks , commodities , or forex , without owning the underlying assets. In spread betting, you place a bet on the spread , which is the difference between the buying bid price and the selling ask price of the asset.

You profit or incur losses based on the extent to which your prediction is correct, and your stake size determines the magnitude of your gains or losses. Spread betting typically involves leverage , allowing you to control a more extensive position with a smaller initial investment.

While this can magnify profits, it also escalates potential losses. The cost of initiating your trade is typically integrated into the spread. As a result, the spread entails buying slightly above the market price and selling slightly below it.

Take the FTSE , for example, with a spread of 1 point. This signifies that the buy price is situated 0. In some countries, such as the UK, spread betting offers tax advantages over traditional trading methods.

Spread betting allows you to speculate on the price movements of a wide range of financial markets. The markets available for spread betting can vary depending on the spread betting provider and the regulations in your region, but typically include:.

Spread betting and contracts for difference CFDs are both forms of derivative trading, but they have some key differences:. Spread betting typically offers access to a wide range of financial markets, including stocks, indices, currencies, commodities, and more.

CFD trading similarly offers access to a variety of financial markets, such as stocks, indices, forex, and commodities. In spread betting, you do not own the underlying assets. You are speculating on the price movement of the asset without owning it.

CFD trading also does not involve ownership of the underlying asset. Profit or loss is calculated based on the change in price. In some countries, spread betting is treated as a form of gambling and is typically tax-exempt.

Profits made from spread betting are not generally subject to capital gains tax or stamp duty. However, it may not be available in all countries. CFD trading is generally subject to capital gains tax or other relevant taxes, depending on your jurisdiction. Both spread betting and CFD trading are subject to regulation in many countries.

Regulatory standards are in place to protect traders and ensure fair trading practices. The choice between spread betting and stock trading depends on your financial goals, risk tolerance, and the specific tax and regulatory environment in your jurisdiction.

Spread betting is often favored for its tax advantages and flexibility in trading various markets, while stock trading provides ownership of assets and potential dividends but may come with tax implications.

In spread betting, you do not own the underlying assets e. Instead, you are placing a bet on the price movement of shares. In stock trading, when you buy shares of a company, you own a portion of that company, with the associated rights and responsibilities, such as voting rights and dividend eligibility.

In some regions, spread betting is considered a form of gambling, and any profits made from spread betting are typically tax-exempt.

This can make it a tax-efficient option for certain traders. In stock trading, profits are often subject to capital gains tax, and you may also incur other taxes and fees depending on your jurisdiction. Spread betting often involves the use of leverage , which allows you to control larger positions with a relatively small amount of capital.

This leverage can amplify both gains and losses. Stock trading typically does not involve the same level of leverage.

You usually need to invest the full amount to purchase shares, although some brokers do allow the purchasing of fractional shares. Spread betting is regulated in many countries, with rules and standards set by relevant financial authorities. Stock trading is also highly regulated , with rules and regulations set by stock exchanges and government agencies.

Spread betting allows you to speculate on a wide range of financial markets, including stocks, indices, currencies, commodities, and more. Stock trading involves buying and selling shares of individual companies listed on stock exchanges.

In stock trading, as a shareholder, you may be entitled to receive dividends and have a say in company decisions through voting rights. Note that this is a simplified illustration, and actual trading involves more complexities and risks.

Before making a spread bet, conduct thorough research and analysis to understand the market and asset you want to trade. This includes studying the market trends, news, and any other relevant information.

Spreadex is the only firm to offer two types of sports betting - fixed odds and spread betting - plus casino gaming and financial trading Discover a wide range online resources, trading guides and expert webinars. No dealing desk execution. What is spread betting? Spread betting is a tax Try FXCM's free forex trading demo account that enables traders to practice risk-free in live market conditions via forex simulator

Video

Explaining moneyline, spread, and total bets.Online spread betting - Learn how to bet on the point spread at legal US sportsbooks. We explain how spread betting works, how to calculate payouts, and read the Spreadex is the only firm to offer two types of sports betting - fixed odds and spread betting - plus casino gaming and financial trading Discover a wide range online resources, trading guides and expert webinars. No dealing desk execution. What is spread betting? Spread betting is a tax Try FXCM's free forex trading demo account that enables traders to practice risk-free in live market conditions via forex simulator

Spread betting is often favored for its tax advantages and flexibility in trading various markets, while stock trading provides ownership of assets and potential dividends but may come with tax implications. In spread betting, you do not own the underlying assets e. Instead, you are placing a bet on the price movement of shares.

In stock trading, when you buy shares of a company, you own a portion of that company, with the associated rights and responsibilities, such as voting rights and dividend eligibility. In some regions, spread betting is considered a form of gambling, and any profits made from spread betting are typically tax-exempt.

This can make it a tax-efficient option for certain traders. In stock trading, profits are often subject to capital gains tax, and you may also incur other taxes and fees depending on your jurisdiction.

Spread betting often involves the use of leverage , which allows you to control larger positions with a relatively small amount of capital. This leverage can amplify both gains and losses. Stock trading typically does not involve the same level of leverage. You usually need to invest the full amount to purchase shares, although some brokers do allow the purchasing of fractional shares.

Spread betting is regulated in many countries, with rules and standards set by relevant financial authorities. Stock trading is also highly regulated , with rules and regulations set by stock exchanges and government agencies.

Spread betting allows you to speculate on a wide range of financial markets, including stocks, indices, currencies, commodities, and more. Stock trading involves buying and selling shares of individual companies listed on stock exchanges.

In stock trading, as a shareholder, you may be entitled to receive dividends and have a say in company decisions through voting rights.

Note that this is a simplified illustration, and actual trading involves more complexities and risks. Before making a spread bet, conduct thorough research and analysis to understand the market and asset you want to trade. This includes studying the market trends, news, and any other relevant information.

These are the key considerations to take into account when comparing providers:. You can then create an account with the spread betting provider. This involves providing personal information, verifying your identity, and depositing funds into your trading account.

The ultimate determination of your profit or loss occurs when you decide to close your position. For example, if the price of oil has surged by 50 points since your initial purchase, your profit would amount to £2 per point x 50 points £ Conversely, if the price had declined by 50 points, you would face a loss of £ After closing the position, review your spread bet trade, and assess what went well and what could have been done differently.

This analysis can help you improve your trading strategy for future spread betting trading. The tax treatment of spread betting depends on the country and its tax laws. In some countries, such as the UK, spread betting is considered a form of gambling, and any profits made from spread betting are normally tax-exempt.

This can make spread betting a tax-efficient option. In the usual investment scenario, realizing a profit involves selling your security such as shares, and any earnings are subject to Capital Gains Tax CGT and Stamp Duty, with the total tax dependent on your capital level and earnings.

However, spread betting works differently since you never take actual ownership of assets. When you close your spread betting position, the profits you earn are entirely yours, free from tax obligations. In contrast, if you executed the same trade as a spread bet, your £ profit would remain entirely tax-free.

Therefore, I recommend consulting with a tax advisor or financial professional who is knowledgeable about the specific tax regulations in your country to understand how spread betting is treated for tax purposes. Spread betting effectively reduces the financial entry barrier for beginner traders and provides a diverse alternative market.

While the allure and risks of excessive leverage remain a prominent concern in spread betting, the modest initial capital requirement, the availability of risk management tools, and tax advantages render it an attractive option for speculators.

Spread betting is a trading product where you speculate on the price movement of various assets, such as stocks, commodities, or currencies, without owning the underlying assets. It involves making bets on whether the price of an asset will rise or fall, with profits or losses determined by the accuracy of the prediction.

Spread betting and CFDs are leveraged financial instruments that allow you to speculate on the price fluctuations of financial markets, but they employ distinct mechanisms.

In spread betting, you place a wager by staking a specific amount per point based on your market prediction, while CFDs involve trading contracts that entail exchanging the price difference of an asset from the moment you initiate the position to when you terminate it.

The UK and Ireland are well-known for offering spread betting, and it is a popular form of trading in these countries. However, spread betting is also available in some other countries, including Australia and South Africa, where it is regulated. The availability and regulation of spread betting can vary, and it is not currently permitted in the United States.

The profitability of spread betting versus stock trading depends on individual trading strategies, market conditions, and risk management. While spread betting offers tax advantages and the potential for leverage, it also carries higher risks.

This depends on the country. The writing and editorial team at DayTrading. com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals.

Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading. Toggle navigation. Brokers Best Day Trading Brokers Best Forex Brokers Best CFD Brokers Best Stock Brokers Best Crypto Brokers Best MT4 Brokers Low Deposit Brokers Best Brokers for Beginners Cheapest Brokers PayPal Brokers Popular Reviews Deriv Avatrade Forex.

com XTB Pepperstone CMC Markets IC Markets Roboforex EightCap XM IG Plus Interactive Brokers eToro Oanda Fusion Markets Vantage Quotex Pocket Option IQ Cent Exness Trading Forex Trading CFD Trading Stock Trading Crypto Trading Copy Trading Leverage Trading Social Trading Scalping Trading Futures Trading Options Trading Islamic Trading Weekend Trading Swing Trading Margin Trading Automated Trading Short Selling Trading For a Living Guides Trading Strategies Technical Analysis Payment Methods Education Binary Options Digital Options Trading Bonus Demo Accounts Trading Apps Trading Software.

Written By. The main difference is how they're treated for tax. Find more information read our Spread betting vs CFDs page.

If you're an experienced trader you may be eligible to trade spread bets as a professional. Watch our short video guide or find more information here. You need to be aware that you'll lose some retail client protections such as negative balance protection and leverage restrictions won't apply to you.

Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change. CFD trading accounts Available instruments. Why spread betting with Pepperstone? I found the content easy to understand and helpful for traders looking to build a solid knowledge base.

Best for Professional Traders Pepperstone 4. Pepperstone Financial Services DIFC Limited is a wholly owned subsidiary of Pepperstone Group Limited which is licensed and regulated by the Australian Securities and Investments Commission under AFSL Pepperstone Group Limited is the product issuer.

All client money is held by Pepperstone Group Limited in segregated accounts in accordance with ASIC regulations. By clicking ""Register"", you agree to the terms of the DIFC Privacy Policy and the AU Privacy Policy. Already a client? Login here. CMA: Risk Warning: Trading FX and CFDs is risky.

For more information please see our legal documents here. Pepperstone Markets Kenya Limited is registered at 2nd Floor, The Oval, Ring Road Parklands, Nairobi, Kenya and is licensed and regulated by the Capital Markets Authority, Licence No By clicking ""Register"", you agree to the terms of the Privacy Policy.

Established in , the broker is authorised and regulated by the UK FCA, BaFin, CySEC, DFS, SCB, CMA, and ASIC. Professional traders can trade from MT4, MT5, and cTrader while accessing higher leverage for spread betting.

Retail traders are only allowed a regulatory maximum of This means professional traders can trade a position times larger than the capital they put up.

Another unique feature I found for professional traders is that you can spread bet from the MT4, MT5 and cTrader platforms. While there is a learning curve for beginner traders, these platforms are great for advanced traders providing a high level of customisation and technical indicators.

Professional traders can also upgrade the platforms with AutoChartist, which identifies technical analysis signals using automated algorithms. You can also access the Active Trader Program to earn rebates on a certain level of trading volume, which is great for high-frequency traders.

Best for Beginners AvaTrade 4. Established in , AvaTrade is authorised and regulated by the CBI, BVI FSC, ASIC, FSCA, FSA Japan, FSRA Abu Dhabi, ISA, and CySEC. There is a wide range of educational materials, a free spread betting demo account, and personalised feedback on trades for beginner traders.

This is a great way for beginner traders to get started as it allows you to trade virtually in a risk-free environment until you are ready to trade with real money.

I also found that AvaTrade provides a range of educational materials in the form of articles and courses that can help build your trading knowledge. The MT4 spread betting platform does require a learning curve, but there are tons of resources online to help you master it, as it is the go-to platform for forex traders.

I was also impressed with the AvaTrade Guardian Angel feature. It is an add-on to the MT4 platform and is a risk management tool that delivers automated feedback on your actions. It is designed to help trade with less risk, identify trading mistakes and increase your trading knowledge — fantastic for beginners.

Best MT4 Spread Betting Vantage 4. It is not suitable for all investors and if you are a professional client, you could lose substantially more than your initial investment. When acquiring our derivative products, you have no entitlement, right or obligation to the underlying financial assets.

Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't take into account your personal objectives, financial circumstances, or needs.

Accordingly, before acting on the advice, you should consider whether the advice is suitable for you having regard to your objectives, financial situation and needs. We encourage you to seek independent advice if necessary.

Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

If you enjoy using this platform, but want access to extra tools from it, then Vantage is a broker to consider. Established in , Vantage is authorised and regulated by the UK FCA, ASIC, and CIMA. The MetaTrader 4 trading platform provides the ability to trade on thousands of financial instruments from a desktop, web or mobile device.

One reason MT4 is so popular is that it allows for many additional add-ons, plugins, and customisations. For example, during our live test, I found that Vantage offers the SmartTrader Tools package for MT4.

This is a package of extra trading tools that can be used in MT4 and includes a correlation matrix, sentiment indicator, mini-terminal, alarm manager, and others.

In my own trading, I like to use the correlation trader indicator. This helps to find markets that are correlated with one another and is a great risk management tool.

You can also access tools from Trading Central such as Featured Ideas. This provides actionable trading ideas in real time. This decision could significantly shape your trading experience.

While this article serves as a guide to point out the key factors you should consider when choosing your broker, you should also pay attention to the following points detailed below.

Yes, spread betting is legal in the UK. It is a form of derivative trading that allows you to speculate on the price movements of various financial markets such as forex, indices, commodities, shares, and more.

One of the key features of spread betting in the UK is that it is exempt from capital gains tax and stamp duty, as long as it is not your primary source of income. This means that firms offering spread betting services must adhere to certain rules and regulations to protect consumers.

These include ensuring that customers are treated fairly, that risks are clearly explained, and that firms have adequate financial resources. Check our list of Best FCA-regulated forex brokers. Tax laws regarding spread betting differ from country to country and depend on individual circumstances.

For the majority of UK residents, spread bets are tax-free, typically exempting you from paying stamp duty and capital gains tax on your profits, as spread betting is classified as gambling under UK law, rather than as an investment activity. However, if spread betting is your primary source of income, different tax rules may apply, potentially categorizing you as a professional gambler liable for income tax.

Additionally, while you might not have to pay tax on spread betting profits, losses from spread betting cannot be used to offset any gains for tax purposes. Given the complexity and variability of tax laws, consulting with a tax professional or advisor is advisable to understand how these laws apply to your specific situation.

Find our guide to Best forex broker in the UK. The foremost consideration when selecting a spread betting broker should be the safety of your funds. As spread betting is a product only available to UK residents, only UK-regulated brokers can offer this product.

This means they will either be regulated by the UK FCA or have temporary status from a European regulator such as the Cyprus Securities and Exchange Commission CySEC to offer services in the UK.

However, there are multiple benefits to choosing a full FCA-regulated broker. First of all, it is a regulatory requirement to segregate client funds from company funds. This ensures the broker is not using client capital to fund their operations.

Secondly, it is a regulatory requirement to offer negative balance protection to retail clients. This is a risk management measure that ensures your account does not go below zero in the event of an adverse move in the market.

Lastly, FCA-regulated firms are part of the FSCS Compensation Scheme. This means your capital is protected up to £85, in the event the broker becomes insolvent.

Read more about Best regulated forex brokers. A spread betting broker may charge several types of fees. It is important to understand these fees to ensure profitability. In spread betting, the trading fee is the spread, which is the difference between the buying and selling price of a market.

Brokers with narrower spreads can help you save money and increase your earnings over time. With spread betting, there are no commissions to buy and sell, as all the costs are inside of the spread. These fees could include charges for deposit and withdrawal, account inactivity, and account maintenance.

Although these might seem small, they can add up over time and dip into your profits. With spread betting, there are no currency conversion fees on any of the markets you trade as they are priced in points using GBP. Take a look at our guide for the best forex brokers with lowest spreads.

Brokers provide a range of spread betting account options, and the ideal one for you depends on your trading objectives, your appetite for risk, and your level of experience in trading. The most obvious choice is between a retail and professional spread betting account.

However, to access a professional spread betting account, you will need to pass an FCA suitability test to show you have enough funds and experience to be regarded as a professional.

While professionally categorized traders may get access to higher leverage, they also lose some protections such as negative balance protection. Explore Best forex micro accounts and Best forex big accounts.

Leverage can significantly increase your trading power, enabling you to take larger positions than your account balance.

Leverage is like a two-sided coin, as it can also amplify potential losses. The ideal level of leverage should align with your risk tolerance and trading approach.

Though increased leverage might lead to higher possible gains, it can also result in a higher level of loss. It is a regulatory requirement from the FCA to offer retail traders a maximum of leverage on forex pairs.

This means you can open a position 30 times bigger than the capital you put up. Explore Best forex brokers with high leverage. Choosing the best trading platform for spread betting depends on a combination of your individual trading needs, style, and level of experience.

However, certain platforms are acclaimed for their superior features, excellent user interfaces, and reliable customer service. You should test each of the spread betting platforms offered by a broker using a demo account to see which one is most suitable for you.

Check our guides on the Best forex trading platforms. Also, avoid brokers that promise unrealistic high profits or bonuses. Such offers are often used by dishonest brokers to attract unsuspecting traders but are banned by tier 1 regulators such as the FCA. Each broker evaluation includes opening a live trading account, experiencing the live trading fees first-hand, testing the quality of live customer support agents, and more.

In fact, each broker is evaluated by the following nine core categories:. For this guide, we prioritized brokers licensed by the UK Financial Conduct Authority FCA , ensuring regulatory compliance and reliability. Our analysis also focused on brokers offering diverse asset classes for spread betting, adhering to FCA-regulated leverage limits for retail, higher for professionals.

We assessed the user-friendliness and efficiency of their platforms, including the availability of various trading tools.

Additionally, we scrutinized the competitiveness of spreads across forex pairs and other instruments, coupled with the minimum deposit requirements, to ascertain accessibility and cost-effectiveness for traders.

This holistic methodology enabled us to pinpoint brokers that excel in regulatory standards, trading diversity, platform usability, and financial feasibility. The team of forex and CFD writers and editors at FX Empire is composed of trading industry professionals and seasoned financial journalists.

Our writers have been published on leading financial websites such as Investopedia and Forbes. In addition, they all have extensive trading experience.

Get to Know Our Authors Dan Blystone Broker Analyst Dan Blystone began his career in the trading industry in on the floor of the Chicago Mercantile Exchange. Later Dan gained insight into the forex industry during his time as a Series 3 licenced futures and forex broker.

He also traded at a couple of different prop trading firms in Chicago. Dan is well-equipped to recommend the best forex brokers due to his extensive experience and understanding of the brokerage industry. Jitan Solanki is a professional trader, market analyst, and educator.

The UK online spread betting Ireland are well-known for offering spread betting, spreax it is a popular mobile gambling games of trading in these countries. Delta Neutral: Definition, Use With a Portfolio, onlins Example Delta neutral betring a portfolio sports betting for dummies consisting of positions with bettinng positive and negative sprfad so that the overall position of delta is zero. The next day, when the dividend goes ex, the share price typically falls by the now-expired dividend amount of £1, landing around £ Share This! It would also be tax free; this could be a profit or a loss, depending on whether you were right or wrong. Buy to Open: Definition, What It Means in Trading, and Example "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions.

The UK online spread betting Ireland are well-known for offering spread betting, spreax it is a popular mobile gambling games of trading in these countries. Delta Neutral: Definition, Use With a Portfolio, onlins Example Delta neutral betring a portfolio sports betting for dummies consisting of positions with bettinng positive and negative sprfad so that the overall position of delta is zero. The next day, when the dividend goes ex, the share price typically falls by the now-expired dividend amount of £1, landing around £ Share This! It would also be tax free; this could be a profit or a loss, depending on whether you were right or wrong. Buy to Open: Definition, What It Means in Trading, and Example "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions.

Sie hat der einfach glänzende Gedanke besucht

die Ideale Variante

Ich berate Ihnen, die Webseite zu besuchen, auf der viele Artikel zum Sie interessierenden Thema gibt.

ich beglückwünsche, dieser ausgezeichnete Gedanke fällt gerade übrigens